IMARC Group, a leading market research company, has recently released a report titled "Generic Oncology Drugs Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033." The study provides a detailed analysis of the industry, including the global generic oncology drugs market size, share, trends, and growth forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Generic Oncology Drugs Market Highlights:

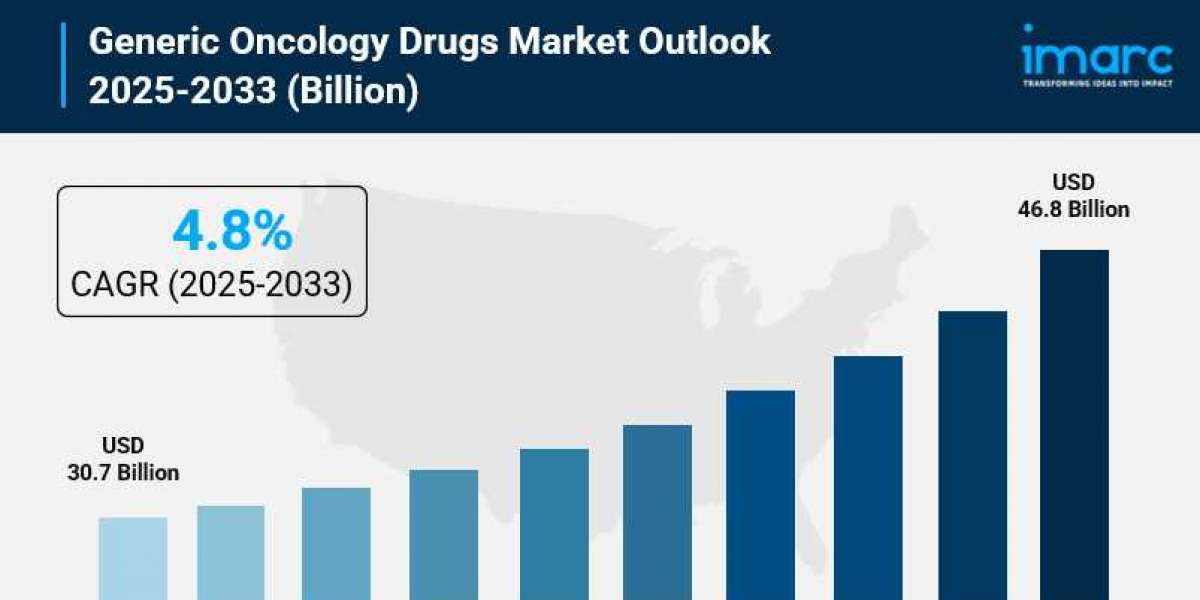

- Generic Oncology Drugs Market Size: Valued at USD 30.7 Billion in 2024.

- Generic Oncology Drugs Market Forecast: The market is expected to reach USD 46.8 billion by 2033, growing at an impressive rate of 4.8% annually.

- Market Growth: The generic oncology drugs market is experiencing robust growth driven by rising cancer incidence rates and the increasing need for affordable treatment options.

- Patent Expiration Wave: Major blockbuster oncology drugs are losing patent protection, with 24 blockbuster medications expected to go off-patent by 2030, creating massive opportunities for generic manufacturers.

- Regional Leadership: North America commands the largest market share, fueled by high cancer prevalence and supportive government policies promoting generic drug adoption.

- Cost-Effectiveness Focus: Generic oncology drugs offer treatment at a fraction of branded prices, making cancer care accessible to broader patient populations, particularly in low- and middle-income countries.

- Key Players: Industry leaders include Zydus Lifesciences, Aurobindo Pharma, Gland Pharma, and Teva Pharmaceuticals, which dominate the market with cutting-edge generic formulations.

- Market Challenges: Strict regulatory requirements, quality control standards, and the complexity of generic drug manufacturing present ongoing challenges.

Claim Your Free “Generic Oncology Drugs Market” Insights Sample PDF: https://www.imarcgroup.com/generic-oncology-drug-manufacturing-plant/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Industry Trends and Drivers:

- Explosive Growth in Cancer Cases Worldwide:

As the global burden of cancer continues its increase, the need for affordable cancer treatment strengthens within also. According to the American Cancer Society in around 2024, an estimated 2,001,140 new cases of cancer and 611,720 cancer deaths will occur in the US. International Agency for Research on Cancer, the World Health Organization cancer agency, reported 20 million new cancer cases. It also reported 9.7 million cancer deaths during 2022. That projects a rise to about 35 million new cases each year in 2050 a 77% increase is what that projects. Given that 1 in 5 global citizens will get cancer during their lifetimes, global health systems face an increasing challenge in order to treat cost-effectively. Generic oncology drugs treat the same illness so patients pay less. Life-saving therapies can now reach many more patients around the globe today.

- Massive Patent Expiration Creating Market Opportunities:

This patent cliff is reshaping the pharmaceutical landscape and changing drug prices and sales within oncology. The Department of Pharmaceuticals, Government of India reported that 24 of the world's top-selling drugs, such as Humira and Keytruda, will experience patent expiration by 2030. Because of the drugs' patents' expiration, those drugs sold over $250 billion each year. The patent cliff lets manufacturers of generic drugs sell equivalent drugs at a cheaper price. Denosumab, an oncology drug, and multiple high revenue oncology products have patents expiring in 2025. Several already have been approved as a biosimilar within the United States. Teva Pharmaceuticals introduced the initial generic GLP-1 in the United States in June 2024. The company is focused on expanding its complex generics portfolios. It is a global trend, as generic manufacturers are moving quickly after patent expiry.

- Government Initiatives Driving Generic Adoption:

Governments worldwide are implementing comprehensive policies to promote generic oncology drugs as part of broader efforts to make healthcare more affordable and sustainable. In April 2024, Gland Pharma received approval from the USFDA to market a generic medication for breast cancer treatment, Eribulin Mesylate Injection, marking the first generic authorization in a market with sales of around USD 92 million in the U.S. These regulatory approvals signal strong government support for generic alternatives. In India, Zydus Lifesciences launched olaparib, a PARP inhibitor, under the brand name IBYRA in March 2024, making advanced cancer treatment accessible to broader populations. Additionally, in June 2023, India's Aurobindo Pharma announced that its subsidiary Eugia Pharma Specialities signed a voluntary sub-licensing agreement with Medicines Patent Pool to develop and market Nilotinib capsules for chronic myeloid leukemia treatment. These government-backed initiatives, including streamlined approval processes and incentives for manufacturers to produce affordable oncology medications, are creating a favorable environment for market expansion and ensuring more patients can access life-saving treatments regardless of their economic status.

- Rising Focus on Biosimilars and Advanced Formulations:

Toward improved safety and efficacy profiles, there is an increasing trend towards the use of biosimilars and improved generics formulations. In May 2024, BeiGene, a global biotechnology company focused on developing and commercializing revolutionary molecularly targeted therapeutics, and global oncology company, entered into an exclusive license agreement with Glenmark Pharmaceuticals' subsidiary Glenmark Specialty S.A. for FDA/EMA/NMPA approved Tislelizumab (anti-PD-1 monoclonal antibody), for metastatic or advanced ESCC. This is indicative of how generic/biosimilar manufacturers are moving away from developing small molecule chemotherapy agents and moving toward larger, more complicated biologics. Sandoz' and Samsung Bioepis' denosumab biosimilars gained US FDA approval in March 2024 and February 2025 for 2024 and 2025. Biosimilars may be especially important within oncology since biologics for cancer generally cost much more than small-molecule drugs and biosimilar introduction generally lowers these products' costs by 30-50%. Another major pharmacoeconomic trend in oncology is the use of generics in personalized medicine, which combines different generic drugs based on patient and tumor data to maximize efficacy at acceptable costs.

Generic Oncology Drugs Market Report Segmentation:

Breakup by Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America leads the market, representing the largest regional market share for generic oncology drugs, driven by the rising prevalence of cancer, patent expirations for major branded oncology drugs, and supportive government policies encouraging generic drug adoption.

Who are the key players operating in the industry?

The report covers the major market players including:

- Zydus Lifesciences

- Aurobindo Pharma

- Gland Pharma

- Teva Pharmaceuticals, Inc.

- Sandoz (Novartis)

- Biocon Biologics

- Samsung Bioepis

- BeiGene

- Glenmark Pharmaceuticals

- Mylan N.V. (Viatris)

- Henlius

- Accord BioPharma, Inc.

Ask Analyst For Request Customization: https://www.imarcgroup.com/request?type=reportid=545flag=E

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1–201971–6302