The Polyester Staple Fiber (PSF) Market is witnessing robust growth driven by rising demand across the textile, automotive, and home furnishing industries. Polyester staple fiber, a synthetic fiber produced from polyester polymers, is widely used in apparel, upholstery, nonwoven fabrics, and industrial applications due to its durability, affordability, and versatility. Increasing adoption of recycled PSF, derived from post-consumer PET bottles, is further accelerating market growth as sustainability becomes a global priority. Additionally, growing urbanization, rapid industrialization, and rising disposable incomes in developing economies continue to boost the demand for polyester-based products. The Polyester Staple Fiber Market Trends highlight the growing shift towards sustainable and recycled fibers, driven by advances in textile technology and rising eco-conscious consumer demand.

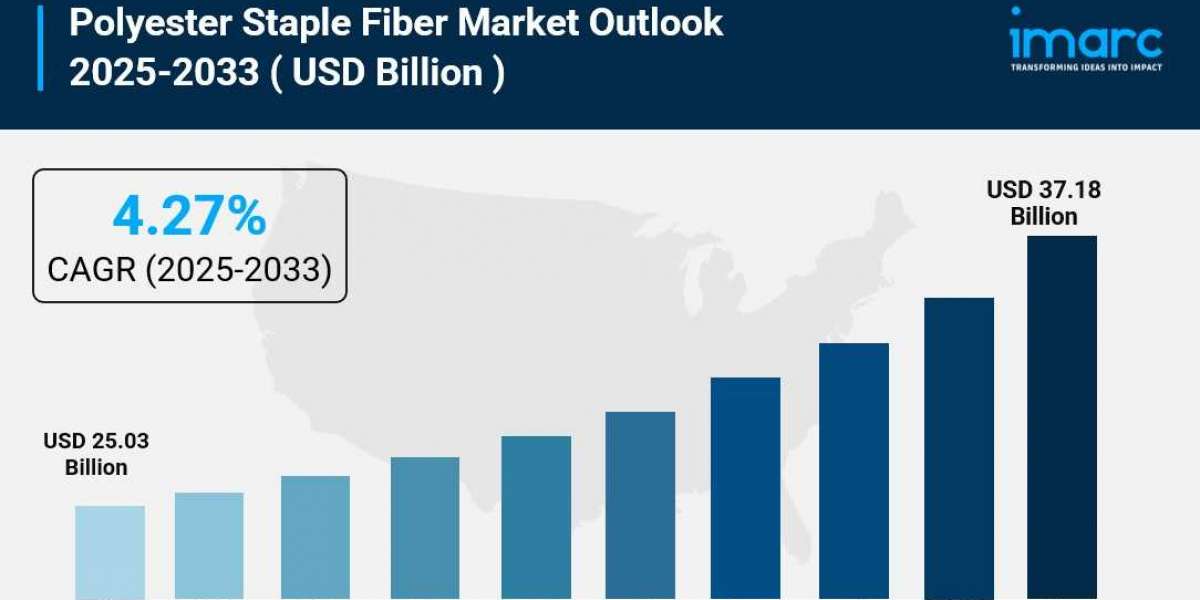

The global polyester staple fiber market size was valued at USD 25.03 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 37.18 Billion by 2033, exhibiting a CAGR of 4.27% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 77.6% in 2024. The market is driven by rising textile demand, particularly in fast-fashion and activewear, due to its affordability and durability. Growth in non-woven applications such as automotive, construction, and hygiene products enhances consumption. Urbanization and disposable income growth in emerging economies are further expanding the polyester staple fiber market share. Additionally, PSF’s cost and performance advantages over natural fibers drive adoption, while innovations in fiber technology and expanding industrial uses sustain long-term market expansion.

Request Sample URL: https://www.imarcgroup.com/polyester-staple-fiber-market/requestsample

Key Trends

Shift Toward Recycled Polyester: Growing environmental awareness and circular economy initiatives are encouraging manufacturers to invest in recycled polyester staple fiber production.

Technological Advancements: Innovations in spinning, dyeing, and blending technologies are improving fiber quality and performance.

Rising Demand in Home Furnishing and Automotive Sectors: The increasing use of PSF in carpets, upholstery, and vehicle interiors is driving market expansion.

Preference for Lightweight and Low-Cost Materials: Manufacturers are choosing PSF for its cost-effectiveness and favorable mechanical properties compared to natural fibers.

Regional Growth in Asia-Pacific: Countries such as China, India, and Indonesia dominate global PSF production and consumption due to strong textile manufacturing bases and export capabilities.

Market Dynamics

- Drivers:

- Growing textile and apparel production in emerging economies.

- Increasing demand for sustainable and recycled fiber alternatives.

- Expanding applications in nonwoven and industrial fabric sectors.

- Restraints:

- Fluctuating raw material prices, particularly crude oil derivatives used in polyester production.

- Environmental concerns related to microplastic pollution and synthetic fiber disposal.

- Opportunities:

- Advancements in bio-based polyester and recycling technologies.

- Rising investments in eco-friendly manufacturing processes and circular textile solutions.

Industry Trends in the Polyester Staple Fiber Market

The polyester staple fiber (PSF) market is experiencing significant changes driven by various factors, including technological advancements, consumer preferences, and environmental considerations. Here are some key trends shaping the industry:

- Sustainability Initiatives

- Recycled Polyester: There is a growing demand for recycled polyester fibers, driven by environmental concerns and the push for sustainable practices. Brands are increasingly adopting eco-friendly materials to reduce their carbon footprint.

- Circular Economy: The industry is moving towards a circular economy model, focusing on recycling and reusing materials to minimize waste.

- Technological Advancements

- Innovative Production Techniques: Advances in manufacturing processes, such as melt spinning and texturing, are enhancing the quality and functionality of polyester fibers, making them more versatile for various applications.

- Smart Fabrics: The development of smart textiles incorporating PSF is gaining traction, particularly in the fashion and automotive industries, where performance and durability are critical.

- Growing Demand from End-Use Industries

- Textile and Apparel: The textile industry remains the largest consumer of polyester staple fiber, driven by the increasing demand for clothing and home textiles.

- Automotive and Industrial Applications: The use of PSF in automotive interiors and industrial fabrics is expanding, as manufacturers seek lightweight and durable materials.

- Market Expansion in Emerging Economies

- Asia-Pacific Dominance: The Asia-Pacific region, particularly countries like China and India, is witnessing rapid growth in the PSF market due to rising population, urbanization, and increasing disposable incomes.

- Investment in Infrastructure: Emerging economies are investing in infrastructure development, leading to higher demand for polyester fibers in construction and other industrial applications.

- Regulatory Changes

- Stricter Environmental Regulations: Governments are implementing stricter regulations regarding the use of synthetic fibers, encouraging manufacturers to adopt more sustainable practices and materials.

- Consumer Preferences

- Shift Towards Performance Fabrics: Consumers are increasingly favoring high-performance fabrics that offer durability, moisture-wicking properties, and comfort, driving innovation in polyester fiber products.

Segmental Analysis:

Analysis by Origin:

- Virgin

- Recycled

- Blended

Virgin stands as the largest component in 2024, holding around 42.2% of the market due to its superior quality, consistency, and performance in high-end textile and industrial applications. Unlike recycled PSF, virgin fiber offers enhanced strength, uniformity, and dyeability, making it preferred for premium apparel, home textiles, and technical fabrics.

Analysis by Product:

- Solid

- Hollow

Solid leads the market with around 64.2% of market share in 2024, driven by its versatility and widespread use across multiple industries. Its uniform structure and consistent properties make it ideal for textiles, apparel, home furnishings, and industrial applications such as automotive upholstery and filtration.

Analysis by Application:

- Automotive

- Home Furnishing

- Apparel

- Filtration

- Others

Apparel leads the market with around 45.8% of market share in 2024, driven by its widespread use in affordable, durable, and versatile clothing. The fast-fashion industry heavily relies on PSF for its quick production cycles, cost efficiency, and ability to mimic natural fibers such as cotton.

Analysis of Polyester Staple Fiber Market by Regions

- Asia Pacific

- Europe

- North America

- Latin America

- Middle East and Africa

Asia-Pacific accounts for the largest market share of over 77.6% in 2024, driven by robust textile manufacturing, cost-competitive production, and strong domestic demand. Countries including China, India, and Vietnam lead consumption through expanding apparel industries, export-oriented garment production, and growing non-woven applications. The region benefits from well-established supply chains, low labor costs, and government support for synthetic fiber industries.

Ask An Analyst: https://www.imarcgroup.com/request?type=reportid=3869flag=C

Leading Players of Polyester Staple Fiber Market:

According to IMARC Group's latest analysis, prominent companies shaping the global polyester staple fiber landscape include:

- Alpek Polyester

- Bombay Dyeing

- Diyou Fibre (M) Sdn Bhd.

- Huvis Corp.

- Indorama Corporation

- Reliance Industries Limited

- Thai Polyester Co., Ltd

- Toray Industries, Inc.

- Vnpolyfiber

- William Barnet and Son, LLC

- Xin Da Spinning Technology Sdn. Bhd.

These leading providers are expanding their footprint through capacity expansions, technological advancements, sustainability initiatives, and strategic collaborations to meet growing demand across textile, automotive, construction, and industrial applications while adapting to environmental regulations and changing consumer preferences.

Recent News and Developments in Polyester Staple Fiber Market:

- November 2024: The United States imposed a Section 201 safeguard on fine denier polyester staple fiber, setting a zero-import quota with 1 million pound increments annually for four years. This trade policy protects domestic PSF manufacturers while ensuring downstream industry needs are met, marking a fundamental shift in U.S. polyester trade strategy.

- August 2024: UNIFI launched REPREVE, an extensive performance polyester portfolio featuring black and white staple fiber and black filament yarn equipped with inherent tracer technology. This innovation demonstrates the industry's focus on developing traceable, high-performance recycled polyester solutions for premium applications.

- 2024: Americans spent approximately USD 420 billion on home remodeling, driving significant demand for polyester-based home furnishing products including carpets, curtains, and upholstery. This trend reflects growing consumer investment in interior aesthetics and modernization, creating substantial market opportunities for PSF manufacturers.

- 2021-2024: Brazil's PET packaging recycling rate reached 56.4% in 2021, marking a 15.4% increase compared to 2019. This improvement in recycling infrastructure supports the availability of recycled PET bottle flakes for sustainable PSF production, aligning with environmental goals and cost efficiency objectives across Latin America.

- 2024: Saudi Arabia's construction sector expansion includes over 5,200 projects under way valued at USD 819 billion. This massive construction boom across residential and commercial spaces drives demand for durable interior materials, creating significant opportunities for polyester staple fiber in carpets, upholstery, and wall fabrics.

If you require any specific information that is not currently covered within the scope of the report, we will provide the same as part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC's offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249,

USA Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302