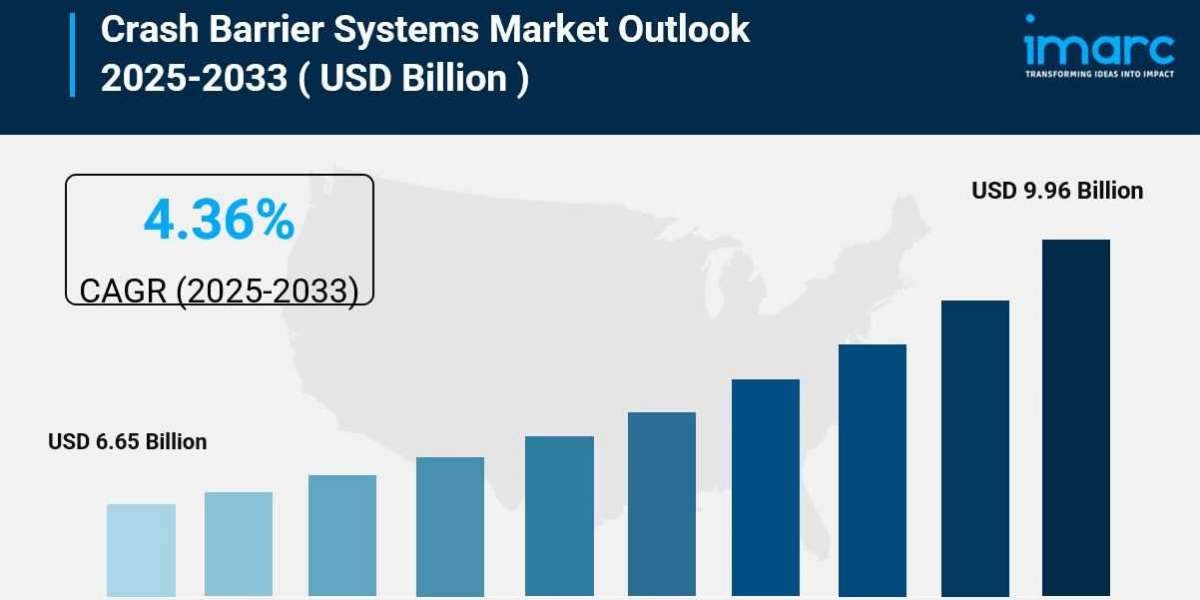

The global crash barrier systems market size was valued at USD 6.4 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 9.5 Billion by 2033, exhibiting a CAGR of 4.59% during 2024-2033. The market is experiencing steady growth driven by the rising number of road accidents and fatalities, escalating awareness of road safety importance, increasing demand for crash barrier systems, and the introduction of intelligent systems and advanced technologies in barrier infrastructure.

Key Stats for Crash Barrier Systems Market:

- Crash Barrier Systems Market Value (2024): USD 6.4 Billion

- Crash Barrier Systems Market Value (2033): USD 9.5 Billion

- Crash Barrier Systems Market Forecast CAGR: 4.59%

- Leading Segment in Crash Barrier Systems Market in 2024: Fixed Barriers (by Type)

- Key Regions in Crash Barrier Systems Market: North America, Europe, Asia Pacific, Latin America, Middle East and Africa

- Top companies in Crash Barrier Systems Market: Valmont Industries, Trinity Industries, Lindsay Manufacturing, Energy Absorption Systems Inc., Holmatro Safety Rescue, Quixote Corporation, Barrier Systems Inc., Cordova Safety Solutions, Guardrails Inc., Traffic Safety Corp., Bekaert, Freeman Manufacturing Supply Company, etc.

Request Customization: https://www.imarcgroup.com/request?type=reportid=8094flag=E

Why is the Crash Barrier Systems Market Growing?

The crash barrier systems market is experiencing meaningful growth as transportation authorities worldwide recognize that effective safety infrastructure saves lives and prevents injuries. This isn't just about regulatory compliance—it's about the fundamental responsibility to protect road users from the devastating consequences of collisions.

Road accidents represent a genuine public health crisis at global scale. The World Health Organization documents that traffic injuries are a severe public health concern across the 53 nations that make up the WHO European Region alone. This reality drives continuous investment in safety infrastructure that can genuinely prevent accidents and mitigate their impact when they occur. Every installed crash barrier system potentially prevents injuries and saves lives, creating powerful motivation for deployment across high-risk locations.

Vehicle ownership continues rising globally, particularly in emerging economies. The Organisation Internationale des Constructeurs d'Automobiles (OICA) projects robust growth in automotive industries across India, Brazil, South Africa, the United States, Canada, Germany, Italy, and Australia—with growth rates exceeding 10% projected over the coming five years. More vehicles on roads inevitably create higher collision risks, intensifying demand for comprehensive safety barriers. This growing vehicle fleet isn't just a statistical abstraction; it represents millions of additional vehicles navigating roads that weren't designed for current traffic volumes, creating genuine safety challenges that crash barriers directly address.

Infrastructure development projects are accelerating worldwide. Roads, highways, bridges, and transportation networks are expanding to accommodate population growth and economic development. Every new construction project incorporates crash barriers as standard safety elements. Governments worldwide are making substantial infrastructure investments that include comprehensive barrier systems. Russia launched a six-year modernization plan with approximately USD 96 billion in investment aimed at enhancing airports, roads, railways, and other key infrastructure areas. Similar initiatives are underway globally, creating sustained demand for barrier systems as essential infrastructure components.

Regulatory frameworks are tightening and becoming more comprehensive. Transportation agencies worldwide have established regulations mandating crash barrier installation in high-risk areas. These aren't merely suggestions—they're legal requirements that ensure new highways, bridges, and dangerous road sections incorporate appropriate barrier systems. The Asia Pacific Road Safety Observatory (APRSO) has established commitments to provide safe, affordable, accessible, and sustainable transport systems by 2030, with implementation of road safety rules and regulations including mandatory barrier systems. India's Ministry of Road Transport and Highways has similarly implemented initiatives bolstering road safety and reducing accidents on National Highways, with crash barrier systems central to these efforts.

Urbanization is driving barrier demand in unexpected ways. Rapid urban expansion requires construction of new residential areas, commercial infrastructure, and transportation networks within densely populated zones. These urban environments create unique safety challenges where barriers protect pedestrians, vehicles, and infrastructure. Commercial real estate development booms also increase demand for railings, gates, and fences—barrier systems that protect property and enhance security. The surge in construction activities is promoting development throughout the crash barrier systems market.

Technology advancement is expanding what crash barriers can accomplish. Beyond traditional steel and concrete, manufacturers are developing high-strength steel, composite materials, and eco-friendly alternatives that improve performance and durability. Integration of smart technologies and Internet of Things (IoT) capabilities is revolutionizing the sector. Connected barrier infrastructure enables real-time monitoring, data analysis, and predictive maintenance that would have been impossible just years ago. These technological advances enhance barrier effectiveness while creating opportunities for innovative approaches to road safety.

Sustainability considerations are becoming increasingly important drivers. Environmental awareness is pushing manufacturers toward recycled or renewable materials. Plastic-based barrier systems offer affordability, reusability, recyclability, and low maintenance costs—advantages that appeal to both manufacturers and infrastructure operators. Companies focusing on manufacturing crash barrier systems composed of plastics with distinctive, easily visible designs are finding ready markets. These sustainable alternatives deliver environmental benefits while meeting performance requirements that road authorities demand.

Customization capabilities are expanding market applications. Manufacturers are increasingly offering solutions tailored to specific road types, traffic volumes, and environmental conditions. Modular barrier designs that can be easily assembled and disassembled provide flexibility and cost-effectiveness, making them attractive for diverse applications from permanent highways to temporary construction zones. This customization capability is expanding addressable markets and enabling barrier systems to meet needs that fixed designs couldn't previously address.

AI Impact on the Crash Barrier Systems Market:

Artificial intelligence is beginning to transform crash barrier systems from passive safety components into intelligent infrastructure elements that actively contribute to road safety management. While AI adoption in this sector is still developing, the trajectory shows tremendous potential for fundamental improvements in how barriers protect road users.

IoT-based real-time monitoring systems powered by AI are providing unprecedented visibility into barrier system status and performance. Embedded sensors collect continuous data about barrier condition, impact forces, structural integrity, and environmental factors. AI algorithms analyze this data to identify patterns indicating maintenance needs or potential failures before they become critical. Predictive maintenance capabilities allow infrastructure managers to schedule repairs proactively rather than discovering damage only after barrier failures, which might allow a collision to occur that could have been prevented by timely maintenance.

Data analytics systems are helping transportation authorities optimize barrier deployment. AI algorithms analyze accident patterns, traffic volumes, vehicle speeds, and environmental conditions to identify locations where barriers would provide maximum safety benefit. This data-driven approach ensures that limited infrastructure budgets are deployed where they save the most lives and prevent the most serious injuries. Rather than installing barriers based on general guidelines, authorities can now use specific data to make informed decisions about barrier placement and specifications.

Crash simulation and modeling powered by AI enables engineers to design increasingly effective barrier systems. Before physical prototyping, AI-driven simulations can test how barriers respond to various collision scenarios—different vehicle types, speeds, angles, and impact conditions. These simulations allow engineers to refine designs and predict performance with accuracy that accelerates development and reduces expensive prototype testing.

Integration with smart city infrastructure enables crash barriers to communicate with traffic management systems. When barriers detect impacts, they can immediately notify traffic management systems, which automatically adjust traffic signals, activate warning systems, and alert emergency services. This coordination creates synergistic safety benefits that extend far beyond what individual barriers accomplish.

Computer vision systems analyzing vehicle and barrier characteristics are improving barrier matching for specific applications. Rather than one-size-fits-all installations, AI systems help determine optimal barrier types for particular locations based on vehicle profiles, traffic patterns, and safety requirements. This customization improves safety effectiveness while optimizing costs.

Looking ahead, fully autonomous barrier systems that can adjust configurations based on real-time conditions represent intriguing possibilities. Automated systems could modify barrier positioning or deployment in response to changing traffic conditions, weather, or accident patterns. While such systems are still developmental, they illustrate the transformative potential of AI in road safety infrastructure.

Request Sample Report: https://www.imarcgroup.com/crash-barrier-systems-market/requestsample

Segmental Analysis:

Analysis by Type:

- Fixed Barriers

- Portable Barriers

Fixed barriers dominated the market in 2024 and continue to represent the largest segment. These barriers serve as permanent safety measures designed to prevent collisions and mitigate risks of vehicles veering off roads into dangerous areas like ravines or water bodies. Fixed barriers are typically installed on roadside highways, mountainous roads, hilly roads, and roadways beside water bodies. They're constructed with steel, concrete, or combinations of both, offering durability and reliability for long-term safety protection. The majority of installation and maintenance occurs on bridges, retaining walls, and building facilities. Their permanence and proven effectiveness make them the default choice for most installations.

Portable barriers represent a rapidly growing segment, particularly in construction zones and temporary safety applications. These mobile systems with wheels employ hydraulically operated mechanisms powered by rechargeable batteries, enabling deployment and removal as needed. Portable barriers provide flexibility for construction zones, accident scenes, special events, and temporary traffic management situations where permanent installation isn't feasible. Their ease of deployment and redeployability make them increasingly attractive to road authorities seeking cost-effective, adaptable safety solutions.

Analysis by Technology:

- Rigid Barriers

- Semi-Rigid Barriers

- Flexible Barriers

Rigid barriers dominated the market, providing maximum impact protection through strong structural construction. These systems absorb collision energy through their solid construction, effectively stopping vehicles and preventing them from penetrating or passing the barrier. Rigid systems offer excellent protection but can result in severe vehicle damage due to the inelastic nature of the collision. Steel cable barriers and concrete walls represent common rigid barrier types.

Semi-rigid barriers combine protective capabilities with some flexibility, allowing moderate deflection while redirecting vehicles safely. These systems balance impact protection with reduced vehicle damage compared to purely rigid systems. W-beam guardrails with vertical support structures represent typical semi-rigid barrier designs.

Flexible barriers absorb energy through movement and deformation, gradually dissipating collision energy to reduce impact forces. These systems typically result in less vehicle damage while still preventing vehicles from entering dangerous zones. Rope and cable systems represent common flexible barrier technologies offering excellent energy absorption characteristics.

Analysis by Application:

- Roadside Applications

- Median Applications

- Bridge Applications

- Work Zone Applications

Roadside barriers protect vehicles from leaving traveled lanes and entering hazardous areas. Roadside applications represent the largest segment and include barriers along highways protecting from ravines, water bodies, and buildings.

Median barriers separate traffic moving in opposite directions, preventing head-on collisions and cross-over accidents. Median applications protect the most vulnerable collision scenarios where vehicles traveling at high speeds toward each other create catastrophic accident potential.

Bridge applications protect vehicles on bridge decks from veering over the side. These specialized installations must accommodate unique structural requirements while providing maximum protection.

Work zone applications provide temporary protection in construction areas where traffic patterns change frequently. These temporary systems require portability and quick deployment characteristics.

Regional Analysis:

North America dominates the crash barrier systems market, driven by extensive highway networks, substantial vehicle populations, and strong regulatory frameworks. High disposable incomes support infrastructure investment, and mature construction practices incorporate barriers as standard safety elements.

Europe represents the second largest market, with particularly stringent road safety regulations and aging infrastructure requiring modernization. European Union initiatives promoting advanced materials ensure structural security, accelerating barrier system adoption with focus on technology integration and sustainability.

Asia Pacific is experiencing rapid growth driven by emerging market construction booms, rising vehicle ownership, and increasing infrastructure investments. China, India, Japan, and Southeast Asian nations are all expanding transportation infrastructure with contemporary safety systems. India's infrastructure development boom and China's highway expansion are driving substantial regional demand.

Latin America is experiencing growth as infrastructure modernization progresses and road safety awareness increases. Brazil and Mexico are primary markets where vehicle ownership growth and infrastructure investment drive barrier system demand.

Middle East and Africa show developing potential as infrastructure projects expand and safety awareness increases. Oil-exporting nations are diversifying economies through infrastructure investment that includes comprehensive road safety systems.

What are the Drivers, Restraints, and Key Trends of the Crash Barrier Systems Market?

Market Drivers:

Road safety imperatives create powerful fundamental drivers. When transportation authorities understand that effective barriers can prevent injuries and save lives, installation becomes a priority regardless of cost considerations. The documented human and financial costs of road accidents justify comprehensive barrier system investment.

Infrastructure development provides consistent market support. Road construction, highway expansion, and transportation network development all incorporate crash barriers as essential safety elements. This ongoing construction activity ensures continuous demand for barrier systems.

Vehicle ownership growth directly drives barrier demand. More vehicles require more safety infrastructure. Emerging market vehicle ownership growth is particularly significant as populations that previously lacked widespread vehicle access now embrace motorization.

Regulatory mandates ensure baseline adoption levels. Government requirements for barrier installation at high-risk locations create regulatory demand that transcends economic cycles and fluctuates minimally based on market conditions.

Market Restraints:

Installation and material costs represent significant barriers to expansion. Advanced crash barrier systems require substantial capital investment, particularly for intelligent systems incorporating IoT and real-time monitoring. Smaller municipalities and developing nations sometimes lack budgets for comprehensive barrier networks, creating adoption gaps.

Raw material price volatility impacts profitability. Steel and concrete price fluctuations directly affect crash barrier system costs. Supply chain disruptions can increase material costs unpredictably, challenging project economics.

Maintenance and repair requirements create ongoing costs. Damaged barriers require timely repair or replacement, adding operational costs for road authorities and infrastructure managers. These ongoing expenses sometimes constrain adoption of more advanced systems requiring sophisticated maintenance.

Aesthetic and environmental concerns occasionally arise. Barrier systems change roadside appearances, and communities sometimes resist installation despite safety benefits. Environmental impact concerns around concrete production and steel manufacturing sometimes create adoption resistance, though innovation in sustainable materials is addressing these concerns.

Market Key Trends:

Sustainability integration is becoming mainstream rather than niche. Eco-friendly materials including recycled composites, sustainable plastics, and low-emission manufacturing are increasingly standard. Carbon footprint considerations and circular economy principles are influencing material selection and manufacturing processes. Solidia Technologies and similar innovators are revolutionizing production through technologies that reduce emissions by up to 40%, demonstrating how sustainability and performance can align.

Smart barrier systems incorporating IoT and real-time monitoring represent the technology frontier. Connected barriers communicating with traffic management systems, providing predictive maintenance alerts, and enabling data-driven optimization represent the future. These intelligent systems command premium pricing but deliver superior performance and cost-effectiveness over system lifespans.

Modular and reconfigurable designs are gaining adoption. Systems that can be easily assembled, disassembled, and reconfigured for different applications provide flexibility that fixed installations cannot. This modularity is particularly attractive for temporary applications and rapid deployment scenarios.

Impact attenuators and end treatments are growing faster than traditional barriers. These specialized components absorb collision energy or prevent vehicle penetration beyond barriers, providing enhanced protection for specific hazards. Their increasing adoption reflects more sophisticated understanding of collision dynamics and tailored safety solutions.

Standardization and certification advancement is ongoing. MASH 16 TL-3 standards and similar certifications establish consistent performance expectations globally. Examples include Valmont Industries' Highway Guard LDS barrier engineered to meet these standards. Standardization facilitates international trade and ensures consistent safety levels.

Leading Players of Crash Barrier Systems Market:

According to IMARC Group's latest analysis, prominent companies shaping the global crash barrier systems landscape include major manufacturers and specialized safety companies that continue driving innovation and market expansion. These companies invest significantly in research and development to advance barrier technology, materials science, and integration capabilities. Strategic partnerships with infrastructure developers, government agencies, and technology companies are accelerating innovation deployment. Companies are focusing on sustainable materials, intelligent systems integration, and customized solutions addressing specific market needs across different geographic regions and applications.

Key Developments in Crash Barrier Systems Market:

- 2024: Government investments in infrastructure development continue accelerating crash barrier adoption globally. Russia's modernization plan, India's highway safety initiatives, and ongoing infrastructure projects worldwide incorporate comprehensive barrier systems as essential safety elements, demonstrating sustained commitment to transportation safety infrastructure.

- 2023: December marked industry innovation with introduction of advanced barrier designs meeting MASH 16 TL-3 standards, reflecting continuous improvement in safety performance and standardization. These certified barriers provide confidence in safety effectiveness and performance consistency across applications.

- Ongoing: Integration of IoT and smart technologies into crash barrier systems represents a fundamental shift from passive to intelligent safety infrastructure. Real-time monitoring, predictive maintenance, and data-driven optimization are becoming increasingly standard in new installations, particularly in developed markets investing in transportation modernization.

- 2024: Sustainable material adoption is accelerating across the sector. Manufacturers increasingly incorporate recycled materials, develop eco-friendly options, and implement low-emission manufacturing processes. Companies are responding to environmental concerns while recognizing that sustainable approaches often improve long-term economics through reduced maintenance and extended system lifespan.

- Emerging: Customization and modular design trends reflect market maturation and sophisticated understanding of specific application requirements. Rather than universal solutions, the trend is toward tailored systems optimized for particular road types, traffic patterns, vehicle profiles, and environmental conditions. This customization enables more effective safety while optimizing costs for specific installations.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Ask An Analyst: https://www.imarcgroup.com/request?type=reportid=8094flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302