Introduction

Managing payroll taxes is one of the most crucial parts of any business. Filing IRS Form 941—the Employer’s Quarterly Federal Tax Return—can be time-consuming and confusing. Luckily, QuickBooks Form 941 simplifies this process by automatically calculating and populating your tax data accurately. Whether you’re using Form 941 QuickBooks Online or the QuickBooks Form 941 Desktop Version, the automation feature ensures compliance, accuracy, and time savings for business owners.

What is Form 941 and Why It Matters for Businesses?

Before diving into how QuickBooks populates Form 941, it’s essential to understand what this form represents.

IRS Form 941 is a federal tax form used by employers to report:

- Income taxes withheld from employees’ paychecks

- Social Security and Medicare taxes withheld

- Employer’s portion of Social Security and Medicare contributions

You must file Form 941 every quarter, even if you have no payroll to report. Missing or incorrect filings can lead to IRS penalties, interest, and compliance issues.

That’s where QuickBooks Form 941 comes into play—it automates the process, reducing errors and ensuring your taxes are filed on time.

How QuickBooks Automates the Form 941 Calculation

When you run payroll in QuickBooks, the software automatically tracks and records all payroll data. This includes wages, tips, bonuses, and tax withholdings. When it’s time to file, QuickBooks populates Form 941 using this existing data.

Here’s how the automation works step-by-step:

Step 1: Payroll Data Collection

Every time you process payroll, QuickBooks automatically gathers key information such as:

- Total employee wages

- Federal income tax withheld

- Employer and employee Social Security tax

- Employer and employee Medicare tax

- Additional Medicare tax (if applicable)

This ensures that your Form 941 QuickBooks Online or Desktop Version has all the information ready to go.

Step 2: Smart Tax Calculations

QuickBooks applies the latest IRS tax tables to ensure calculations are accurate. It uses the data collected during payroll runs to:

- Calculate total taxable wages for the quarter

- Determine total Social Security and Medicare contributions

- Compute federal income tax withholding

The system’s automation reduces the risk of manual calculation errors, ensuring the totals align perfectly with IRS requirements.

Step 3: Auto-Filling IRS Form 941

Once all data is processed, QuickBooks populates Form 941 automatically with accurate figures. This includes:

- Employer information (EIN, name, address)

- Quarterly tax amounts

- Adjustments for sick pay, tips, or group-term life insurance

You can review, verify, and electronically file the form directly from QuickBooks, saving time and effort.

Step 4: Built-in Error Checks

Before filing, QuickBooks runs an internal validation check to ensure that all entries are correct and consistent. If discrepancies occur, it highlights the areas requiring attention—helping you fix them before submission.

QuickBooks Online vs. Desktop Version: How Each Handles Form 941

Both QuickBooks Online Payroll and the QuickBooks Desktop Version offer Form 941 automation. However, there are subtle differences in how each platform handles the process.

1. Form 941 in QuickBooks Online

When using Form 941 QuickBooks Online, the software automatically calculates and populates all the required information after each payroll run.

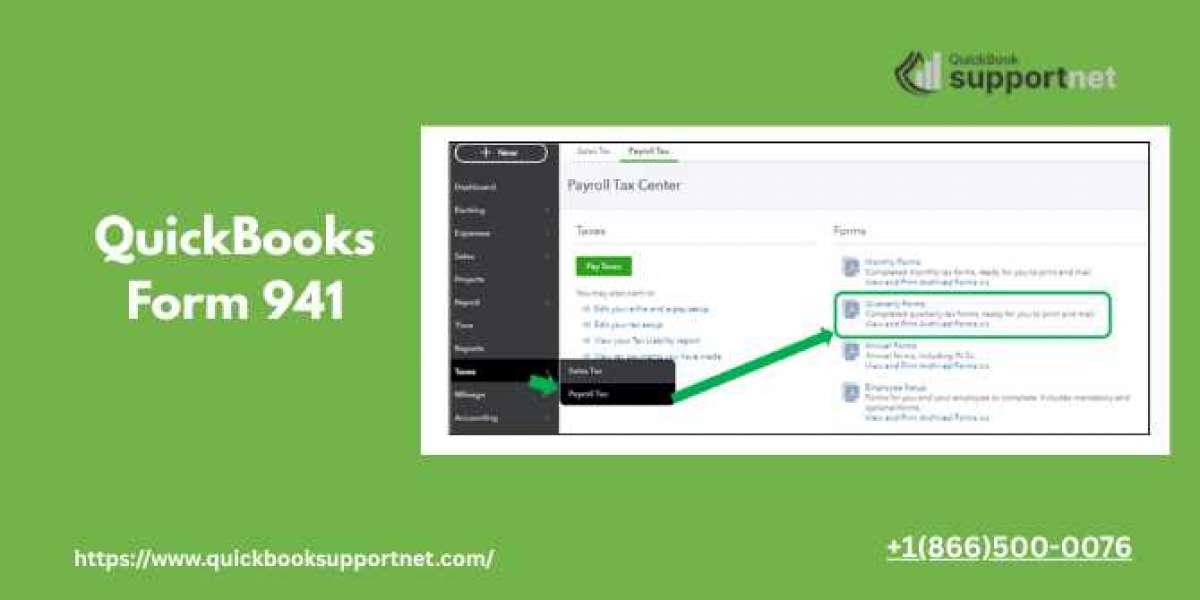

- You can access the form under Taxes → Payroll Tax → Quarterly Forms → Form 941.

- It allows e-filing directly to the IRS with a few clicks.

- The system automatically updates tax tables, so you’re always compliant with the latest IRS rules.

You can also print or save a copy of your filed Form 941 for your records.

2. Form 941 in QuickBooks Desktop Version

If you’re using QuickBooks Form 941 Desktop Version, the process is equally efficient but requires manual updates for tax tables via payroll updates.

- Navigate to Employees → Payroll Tax Forms → Process Payroll Forms → Form 941.

- QuickBooks Desktop then auto-fills the form with your payroll data.

- You can choose to efile or print the form before submitting it to the IRS.

For best results, make sure your QuickBooks Desktop Payroll is up to date. You can reach QuickBooks Payroll Support at +1(866)500-0076 if you need assistance with payroll updates or form submission.

Key Fields That QuickBooks Populates Automatically on Form 941

When QuickBooks populates Form 941, it auto-fills critical fields based on your payroll data. Here’s what gets populated automatically:

- Line 1–6: Employee count and wages

- Line 2–5: Taxable wages and income tax withheld

- Line 7–9: Adjustments for tips, sick pay, etc.

- Line 10–16: Social Security and Medicare tax breakdown

- Line 17–25: Deposits, balances due, and overpayment amounts

The software’s automation ensures compliance and consistency, reducing the chance of human error.

Why You Can Trust QuickBooks’ Form 941 Calculations

The automation in QuickBooks Form 941 is backed by accurate payroll data and up-to-date tax tables. Here’s why thousands of businesses rely on it:

- IRS Compliance: QuickBooks is always aligned with the latest IRS tax code changes.

- Reduced Errors: Automated calculations eliminate manual math errors.

- Time Efficiency: Form generation takes minutes, not hours.

- Data Accuracy: Pulls real-time payroll data without manual entry.

- Seamless E-filing: Direct submission to the IRS saves time.

Common Issues While Generating Form 941 in QuickBooks

While automation is reliable, you might occasionally face issues. Common problems include:

- Incorrect employee payroll setup

- Missing payroll updates

- Outdated QuickBooks tax table

- E-filing errors or submission delays

If you encounter any of these issues, contact the QuickBooks Payroll Help Desk at +1(866)500-0076 for instant assistance.

Tips to Verify Form 941 Accuracy Before Filing

Even though QuickBooks populates Form 941 automatically, verifying accuracy is always a good idea. Here are a few best practices:

- Review Payroll Summaries: Check your payroll summary report for any missing or incorrect employee data.

- Match Tax Payments: Ensure the tax deposits match the amounts reflected in Form 941.

- Reconcile Quarterly Reports: Reconcile payroll liabilities with your balance sheet to confirm consistency.

- Run Payroll Reports: Use QuickBooks’ built-in reports like “Payroll Tax Liability” to cross-verify amounts.

- Backup Data: Before e-filing, back up your company file for safety.

Benefits of Using QuickBooks for Form 941 Filing

Using QuickBooks Form 941 automation comes with several advantages:

- Automatic Tax Table Updates: Always compliant with IRS requirements.

- Simplified E-Filing: Submit directly to the IRS within QuickBooks.

- Pre-Filled Information: No manual data entry required.

- Error-Free Calculations: Ensures accuracy in Social Security, Medicare, and income tax data.

- Audit Trail: Keep a detailed record for future reference.

These features make QuickBooks one of the most efficient payroll tax solutions available for small and medium-sized businesses.

Final Thoughts: Let QuickBooks Handle Form 941 for You

Filing IRS Form 941 doesn’t have to be stressful. Thanks to QuickBooks Form 941 automation, businesses can file accurate and timely returns with minimal effort. Whether you’re using Form 941 QuickBooks Online or the QuickBooks Form 941 Desktop Version, the platform ensures your payroll data is correctly calculated and reported to the IRS.

If you’re ever unsure about calculations, updates, or e-filing procedures, don’t hesitate to get expert help. Call the QuickBooks Payroll Support Team at +1(866)500-0076 for quick and reliable assistance.

For more detailed QuickBooks tips, troubleshooting guides, and payroll support, visit QuickBooksupportnet — your trusted source for professional QuickBooks guidance and solutions.