IMARC Group has recently released a new research study titled “Mexico Adult Diaper Market Size, Share, Trends and Forecast by Type, Distribution Channel, and Region, 2025-2033,” which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Mexico Adult Diaper Market Overview

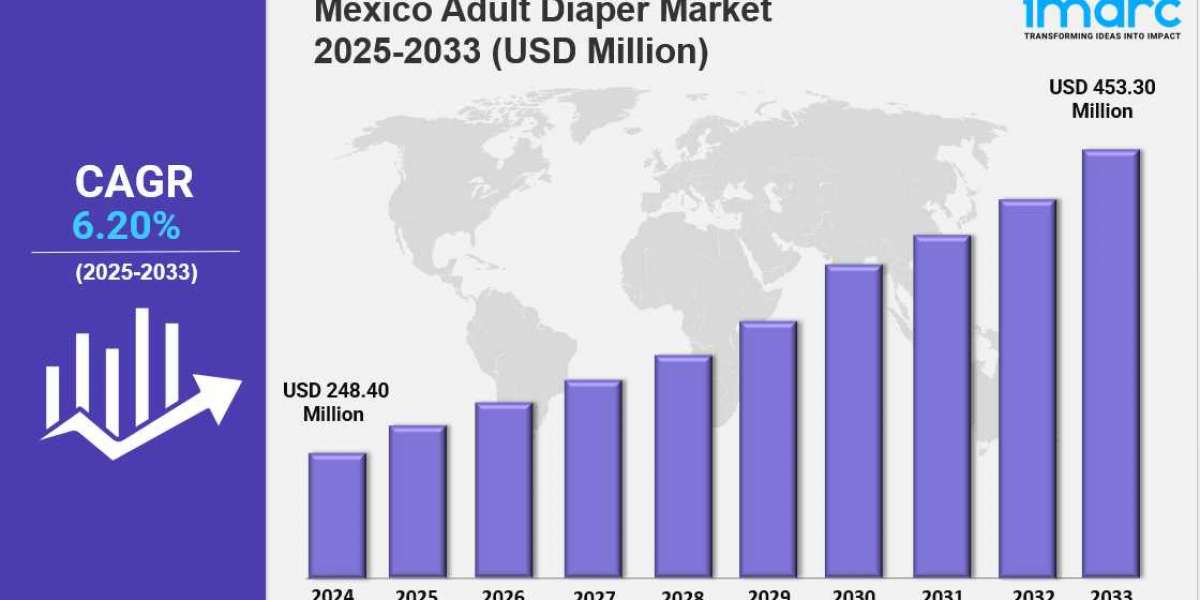

The Mexico adult diaper market size reached USD 248.40 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 453.30 Million by 2033, exhibiting a growth rate (CAGR) of 6.20% during 2025-2033.

Market Size and Growth

Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 248.40 Million

Market Forecast in 2033: USD 453.30 Million

Market Growth Rate 2025-2033: 6.20%

Request for a sample copy of the report: https://www.imarcgroup.com/mexico-adult-diaper-market/requestsample

Key Market Highlights:

✔️ Strong market growth driven by rising aging population and increased awareness of incontinence care

✔️ Growing acceptance of adult diapers for both medical and lifestyle-related needs

✔️ Expanding product innovations focused on comfort, skin health, and discreet wearability

Mexico Adult Diaper Market Trends

The Mexico adult diaper market is growing steadily as an aging population and rising healthcare awareness reshape consumer demand. Today, more than 15% of Mexicans are over the age of 60—a number expected to double by 2040. This demographic shift, combined with higher rates of chronic conditions such as diabetes, mobility issues, and incontinence, is fueling strong demand across hospitals, pharmacies, and retail channels. These factors are laying the foundation for sustained Mexico adult diaper market growth.

According to Mexico’s 2024 National Health Survey, daily adult diaper usage among older adults has climbed to 23%, compared to 18% just four years ago. Manufacturers are responding with improved products made from biodegradable materials, featuring enhanced comfort, leak protection, and breathable designs. Urbanization is also playing a role—since over 80% of the population now lives in cities, fewer families have access to home caregivers, leading to greater reliance on convenient, hygienic incontinence products and contributing to a larger Mexico adult diaper market share.

Healthcare Policies Strengthening Market Expansion

Public healthcare reforms are helping drive accessibility. The introduction of Seguro Popular 2.0 in 2024 extended adult diaper coverage for low-income patients, increasing demand across hospitals and clinics by nearly 37%. The private healthcare sector is also growing, particularly through Mexico’s expanding medical tourism industry—worth over $4 billion—where clinics now use high-quality antimicrobial diapers for patient recovery and post-surgical care.

E-commerce platforms such as Mercado Libre are also shaping Mexico adult diaper market trends, reporting a 68% rise in online diaper sales and a sharp increase in cross-border purchases. Meanwhile, new ISO 13485 certification standards for medical-grade products have led to industry consolidation, with 14 mergers and acquisitions in 2024 that strengthened quality and competitiveness across major brands.

Changing Social Perceptions and Consumer Preferences

Cultural attitudes toward adult diaper use are evolving rapidly. Awareness campaigns led by NGOs and healthcare influencers are reducing stigma and framing incontinence as a normal medical issue. A 2024 IMSS survey found that 61% of Mexicans now view adult diapers as essential healthcare products, up from 42% in 2020.

Gender-specific designs are becoming more common—products tailored for men, especially those with prostate-related conditions, now represent nearly 30% of sales. Among women aged 30–55, stress incontinence accounts for roughly 40% of overall Mexico adult diaper market growth. Subscription services with discreet packaging and home delivery options are also gaining traction, while social media movements such as SaludSinVergüenza have helped normalize conversations around incontinence.

The market is experiencing a surge in innovation. Smart diapers with built-in moisture sensors now account for around 17% of total revenue and command higher prices due to their convenience. Pharmacies continue to dominate medical-grade product sales, holding more than half the market, while supermarkets lead in affordable, value-based options.

Sustainability has become a defining feature of the Mexico adult diaper market outlook, with nearly 70% of consumers expressing a willingness to pay more for compostable or biodegradable products. This shift is pushing manufacturers to invest in eco-friendly materials and circular packaging solutions.

Supply Chain Developments and Market Forecast

Although the market is expanding rapidly, challenges such as currency fluctuations and supply chain dependency on imported absorbent materials persist. To manage costs, manufacturers are turning to nearshoring strategies, opening new production plants in Nuevo León to benefit from the USMCA trade framework.

Looking ahead, the Mexico adult diaper market forecast points to strong growth through 2030, with an expected CAGR of about 11.4%. Innovation, healthcare integration, and sustainable manufacturing will remain the core drivers of market expansion. As consumer awareness and accessibility improve, Mexico’s adult diaper sector is poised for steady progress—balancing comfort, dignity, and environmental responsibility.

Ask Analyst Browse Full Report with TOC List of Figures: https://www.imarcgroup.com/request?type=reportid=33945flag=C

Mexico Adult Diaper Market Segmentation:

The market report segments the market based on product type, distribution channel, and region:

Breakup by Type:

- Adult Pad Type Diaper

- Adult Flat Type Diaper

- Adult Pant Type Diaper

Breakup by Distribution Channel:

- Pharmacies

- Convenience Stores

- Online Stores

- Others

Breakup by Region:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Key Highlights of the Report

1. Market Performance (2019-2024)

2. Market Outlook (2025-2033)

3. COVID-19 Impact on the Market

4. Porter’s Five Forces Analysis

5. Strategic Recommendations

6. Historical, Current and Future Market Trends

7. Market Drivers and Success Factors

8. SWOT Analysis

9. Structure of the Market

10. Value Chain Analysis

11. Comprehensive Mapping of the Competitive Landscape

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91-120-433-0800

United States: +1 201971-6302