Are you wondering how to print Form 1099 in QuickBooks quickly this year? Whether you use QuickBooks Online or QuickBooks Desktop, the process can seem daunting if you’re doing it for the first time. Fortunately, with the right steps, you can prepare and print 1099 forms efficiently without errors. In this guide, we will walk you through every detail, making the 1099 filing process fast and stress-free.

Printing 1099 forms in QuickBooks requires a combination of preparation, correct setup, and understanding of the software workflow. Below, we explore the entire process from start to finish.

Step 1: Prepare Your QuickBooks for 1099 Forms

Before you print, ensure that your QuickBooks company file is ready:

Verify Vendor Information: Only vendors with payments that meet IRS thresholds will need 1099s. Check their payment records for the year.

Enable 1099 Tracking:

Go to Edit Preferences Tax:1099.

Click Company Preferences.

Select Yes to track payments for 1099.

Update Software: Make sure you are using the latest QuickBooks version. You can print Form 1099 in QuickBooks desktop download updates from Intuit if required.

Step 2: Categorize Payments Correctly

The IRS requires certain payments to be reported on 1099 forms:

Box 1 – Nonemployee Compensation: Payments to independent contractors.

Box 7 – Miscellaneous Income: For certain other payments.

QuickBooks automatically maps vendor payments to these boxes if categories are correctly assigned.

Tip: Misclassified payments may result in IRS penalties, so double-check categories.

Step 3: Access the 1099 Wizard

QuickBooks has a built-in 1099 wizard to simplify the printing process:

Go to Vendors Print/E-file 1099s.

Click Get Started to launch the 1099 Wizard.

Follow the prompts to select vendors and review payments.

This step is essential to ensure that your forms are accurate before printing.

Step 4: Review 1099 Forms

Before printing, verify that all details are correct:

Vendor name, address, and Tax ID.

Payment amounts for each 1099 category.

Total payments match your QuickBooks reports.

Pro Tip: Use QuickBooks reports to reconcile totals and identify discrepancies before printing.

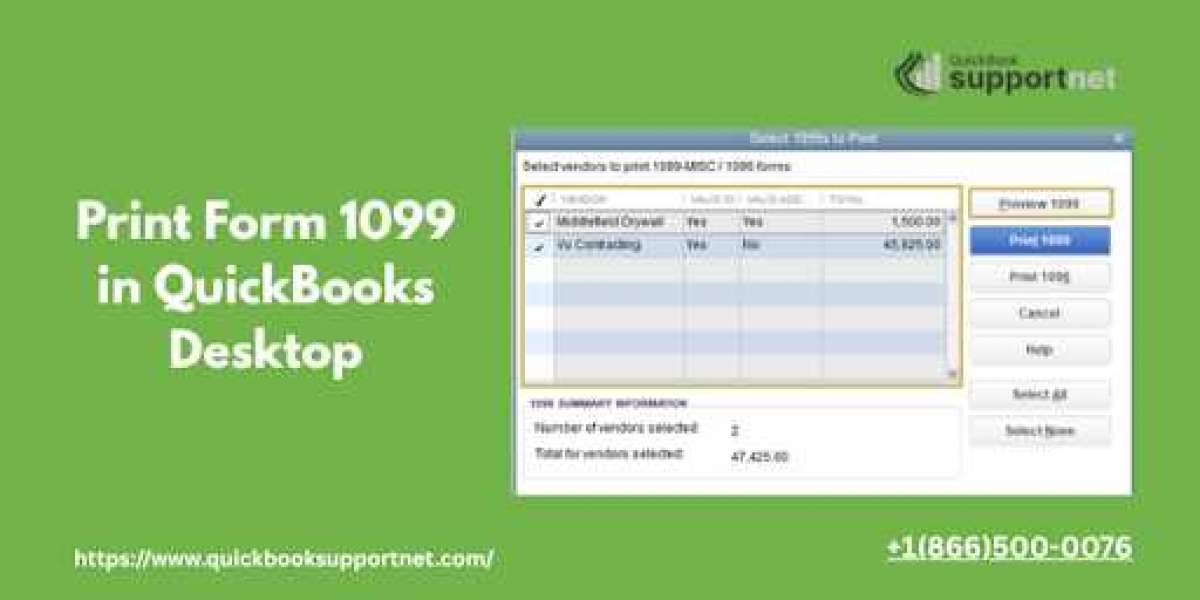

Step 5: Print 1099 Forms in QuickBooks

Once verified, you can print forms directly:

Insert the official 1099 form into your printer.

Select Print 1099s in the wizard.

Choose Print on Pre-printed Forms or Print on Blank Paper as needed.

Review the preview to ensure alignment is correct.

If you encounter printing issues, ensure your printer settings and QuickBooks alignment are properly configured.

Step 6: Filing 1099 Forms Electronically (Optional)

QuickBooks also allows e-filing 1099 forms for faster IRS submission:

Click E-file in the 1099 wizard.

Verify vendor information again.

Submit forms electronically to avoid postal delays.

This method is increasingly recommended for businesses aiming for efficiency and security.

Step 7: Save Your 1099 Records

After printing, save digital copies for your records:

Use PDF format for easy storage.

Keep copies for at least 3 years in case of audits.

QuickBooks allows exporting of 1099 forms for backup.

Common Issues When Printing 1099 Forms in QuickBooks

Misaligned forms on pre-printed sheets.

Missing vendor Tax IDs.

Wrong categorization of payments.

Software not updated to latest QuickBooks version.

Most of these issues can be fixed by reviewing your vendor list and using the QuickBooks Check for Updates option.

FAQs

Q1: Can I print 1099 forms in QuickBooks Desktop?

Yes, QuickBooks Desktop allows you to print 1099 forms using the built-in 1099 Wizard.

Q2: How do I download QuickBooks updates for 1099 printing?

Go to Help Update QuickBooks Desktop to download the latest update and ensure compliance.

Q3: What should I do if my 1099 forms don’t align correctly?

Adjust printer alignment settings or try Print on Blank Paper to troubleshoot alignment issues.

Q4: Is electronic filing of 1099 forms possible in QuickBooks?

Yes, QuickBooks allows e-filing directly to the IRS, which is faster and secure.

Q5: Who should receive 1099 forms?

Independent contractors and vendors who were paid over the IRS threshold during the tax year.

Read Blog:- https://successcircle.online/read-blog/7685