Auto repair software has moved from a “nice-to-have” garage tool to a core operating system for independent shops, dealership service centers, and mobile mechanics. These platforms typically combine estimating, repair order (RO) management, shop scheduling, parts sourcing, digital vehicle inspection (DVI), customer relationship management (CRM), inventory, and accounting integrations.

The shift is propelled by rising vehicle complexity, customers’ expectation of transparent digital experiences, and persistent technician shortages that make workflow automation essential. Cloud delivery, mobile-first interfaces, and integrations with OEM service data and e-commerce parts catalogs now define the category. As repair volumes normalize in the post-pandemic era and vehicles stay on the road longer, software that boosts bay utilization, first-time fix rates, and customer retention is capturing budget priority for service leaders.

Key Growth Drivers

1) Vehicle Complexity Data Dependence. Modern vehicles—laden with ADAS sensors, EV powertrains, and software-defined components—require accurate service information and precise diagnostics. Platforms that embed OEM procedures, TSBs, wiring diagrams, and labor time guides alongside guided workflows reduce diagnostic time and comebacks.

2) Digital Customer Journey. Consumers want Uber-like clarity: online booking, upfront estimates, SMS approvals, real-time status, and easy payments. Shops that adopt digital inspections with photos and videos see higher estimate approvals and stronger trust. Auto repair software turns episodic visits into an ongoing communications loop via reminders and loyalty tools.

3) Operational Efficiency Technician Productivity. With chronic technician shortages, shops must maximize hours per RO and billable utilization. Scheduler optimization, bay loading, canned jobs, and VIN decoding automate repetitive tasks, while time clocks and technician scorecards expose bottlenecks. Integrations with DMS/accounting eliminate double entry.

4) Parts Availability Price Transparency. Integrations with multiple suppliers allow instant price/availability comparisons, e-ordering, and automatic updates to estimates. As margins get squeezed, software that supports smart sourcing and markup rules protects profitability.

5) Compliance Payment Modernization. Digitized work authorizations, audit trails, and tax handling reduce risk. Embedded payments and financing options (BNPL, service financing) remove friction at checkout and improve average RO values.

Market Segmentation

By Deployment:

- Cloud/SaaS: Fastest-growing, favored by multi-location operations for centralized reporting, easy updates, and remote access.

- On-Premises: Persists in shops with poor connectivity or strict data control requirements, but share is gradually declining.

By Shop Type:

- Independent General Repair: Largest user base seeking all-in-one platforms.

- Dealers Franchise Networks: Prioritize OEM data, warranty workflows, and enterprise analytics.

- Specialty Shops (Tires, Collision, Quick Lube): Require vertical features like tire fitment, parts matrices, body labor databases, and insurer integrations.

- Mobile Mechanics: Need lightweight, mobile-first solutions with geoscheduling and on-site payment capture.

By Feature Set:

- Core RO Estimating Suites (work orders, labor times, parts): entry point for small shops.

- Advanced Workflow DVI: photo/video inspections, status boards, and customer approvals.

- Integrated CRM/Marketing: reminders, campaigns, reputation management, and retention analytics.

- Business Intelligence: multi-store dashboards, profitability reports, technician metrics, and predictive insights.

- Integrations: accounting (QuickBooks, Xero), eCommerce parts networks, payment gateways, OEM data feeds, telematics.

Technology Trends

Digital Vehicle Inspections (DVI). Visual storytelling drives transparency and higher approval rates. The best DVIs link findings to canned jobs and parts with one-tap upsells.

AI Predictive Maintenance. Early adopters use AI to parse DTCs, propose next steps, and forecast parts needs or likely failures based on mileage, climate, and driving profiles. Natural language assistants for estimate building and SOP lookup are emerging.

Connected Car Telematics. APIs ingest odometer readings, fault codes, and maintenance schedules from fleets or consumer devices, triggering automated outreach (“Your brake pads are approaching limit—book now”).

Payments Fintech. Embedded checkouts, stored cards, and financing are standardizing. Fee transparency and reconciliation dashboards matter as margins tighten.

Cybersecurity Data Ownership. With more integrations and remote access, role-based permissions, audit logs, encryption, and clear data-use policies are mandatory—especially for larger operators.

Competitive Landscape

The ecosystem includes:

- All-in-One Shop Management Suites offering RO, scheduling, DVI, and CRM under one roof.

- Vertical Specialists for collision, tire/alignments, and quick lube with insurer links or tire fitment databases.

- Add-On Analytics Marketing Platforms that layer on top of shop systems.

- OEM/Dealer Solutions integrated with factory service info, warranty systems, and recall databases.

Differentiation hinges on ease of use, integration breadth, quality of OEM/aftermarket data, onboarding speed, and customer support. Low switching costs push vendors to compete on workflow polish and proven ROI (e.g., increase in ARO, reduction in cycle time).

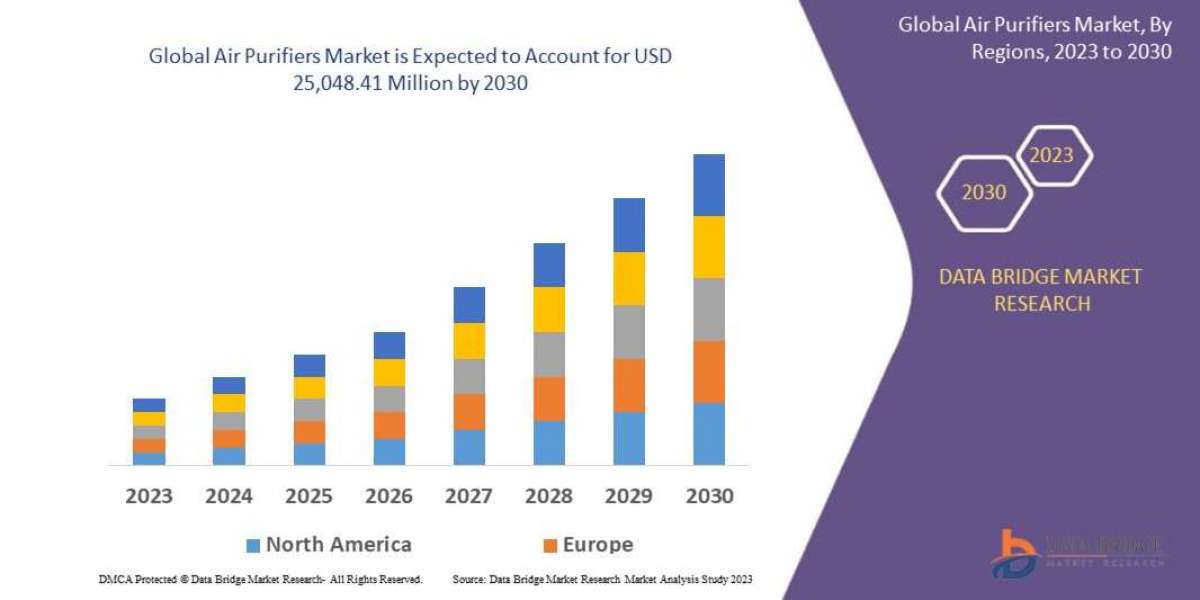

Regional Dynamics

North America: Mature adoption with high SaaS penetration and fragmented independent shop population. Strong demand for marketing/reputation tools and DVI to combat competition and price-sensitive customers.

Europe: Greater emphasis on compliance, multi-language, and data access rules; strong adoption among dealer groups and growing interest from fast-fit chains.

Asia-Pacific: Fastest growth as formalized service chains expand and digitization accelerates among SMEs. Localization (tax, language, OEM coverage) is decisive.

Middle East Africa, Latin America: Early-stage cloud adoption; mobile-first solutions and flexible pricing appeal to emerging networks and franchise concepts.

Buyer Priorities ROI

Implementation speed and training determine change management success. Intuitive UIs cut ramp-up time for technicians who dislike admin work. Open integrations future-proof the stack as shops add ADAS calibration, EV service, or new suppliers. Reporting depth matters for multi-location owners seeking consistency in KPIs: ARO, billed hours per RO, technician efficiency, comeback rate, and bay utilization. Effective platforms routinely report:

- Higher estimate approval rates (via DVI and SMS approvals)

- Reduced parts procurement time (multi-supplier punchout)

- Lower no-shows (automated reminders)

- Improved cash flow (embedded payments, financing)

Challenges Risks

- Data Silos Integration Gaps: Poor syncing between shop software, accounting, and third-party tools creates errors and rework.

- Change Management: Veteran technicians may resist digital inspections or clocking; hands-on onboarding and role-based rollouts help.

- Cost Sensitivity: Small shops weigh subscriptions against thin margins; clear ROI and tiered plans are critical.

- Cyber Compliance: As systems centralize customer and payment data, vendors must keep pace with security expectations.

- Right-to-Repair OEM Data Access: Policy shifts can influence access to diagnostics and repair procedures, affecting software roadmaps.

What to Look For When Selecting a Platform

- Essential Modules: RO/estimating, parts integrations, scheduler, DVI, CRM, inventory, payments, accounting sync.

- Usability: Mobile apps for techs, drag-and-drop calendars, canned jobs, VIN decoding, and keyboard-friendly workflows.

- Data Content: Built-in OEM/aftermarket service data, TSBs, wiring diagrams, and labor guides.

- Open Ecosystem: REST APIs, app marketplaces, and documented webhooks to connect marketing, telematics, or BI.

- Analytics: Store- and technician-level KPIs, cohort analysis on customers, and profitability by job type.

- Support Training: Live onboarding, knowledge bases, in-product tips, and certification for service advisors.

Outlook

Over the next three to five years, the auto repair software market will deepen its role as the operating core of the shop. Expect tighter orchestration between diagnostics, calibrations (especially ADAS), and parts sourcing, reducing time-to-repair. AI copilots will accelerate estimating and triage, while predictive campaigns—driven by telematics and service history—will stabilize car counts without discounting. As EV parc share rises, platforms that incorporate high-voltage safety workflows, battery health reports, and specialized tooling catalogs will differentiate. Consolidation among vendors is likely, but openness and interoperability will remain decisive as forward-looking operators build modular, data-rich service stacks.