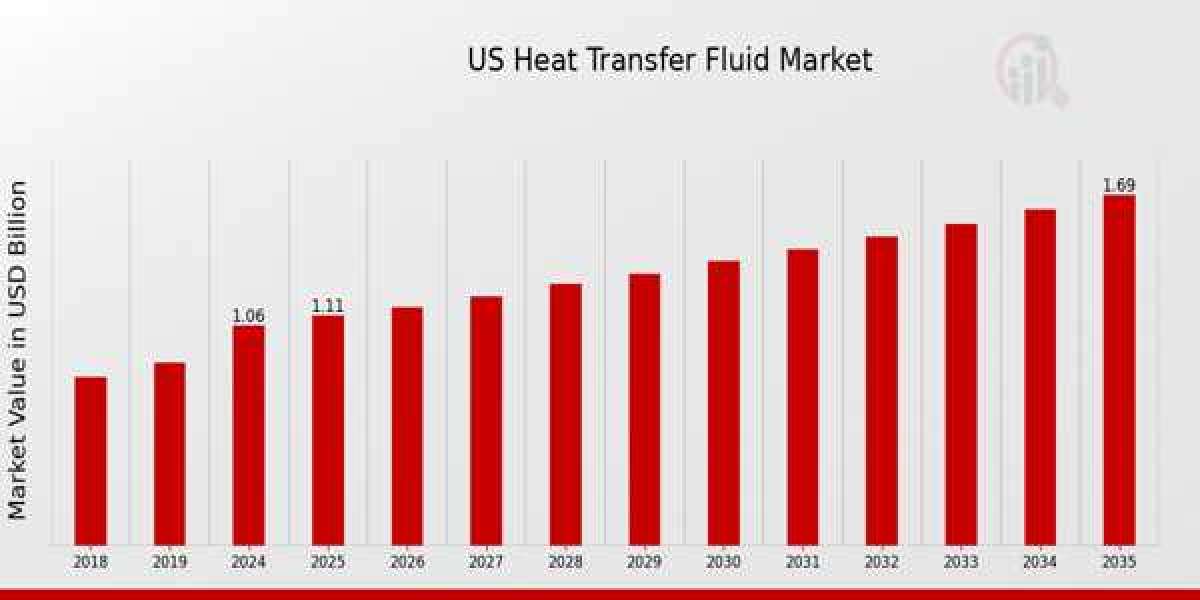

The US heat transfer fluid market is experiencing significant growth, propelled by the increasing demand for energy-efficient heating and cooling solutions across industrial and commercial sectors. Heat transfer fluids (HTFs) are integral to temperature regulation in a wide range of processes, from solar power generation and chemical processing to HVAC systems and food production. As the U.S. economy intensifies its focus on clean energy, efficient operations, and sustainability, the adoption of advanced HTFs is gaining momentum.

Market Dynamics

Growth of Industrial Manufacturing and Processing

The resurgence of manufacturing activities and industrial processing in the U.S. has led to a substantial rise in the usage of heat transfer fluids. Industries such as oil gas, food and beverages, plastics, and pharmaceuticals rely heavily on precise thermal control, which HTFs enable. These fluids help transfer heat with high efficiency, ensuring smooth operations while minimizing energy loss.

In the petrochemical and chemical industries, for example, HTFs are used in reactors, condensers, and reboilers, maintaining temperature uniformity and process reliability. With increased demand for chemicals and fuels, particularly from export markets, HTFs have become critical to safe and efficient production.

Rise of Renewable Energy Applications

Renewable energy applications, particularly concentrated solar power (CSP) systems, are significantly contributing to the market’s growth. HTFs, such as synthetic oils and molten salts, are used in CSP systems to absorb and transfer solar heat to generate electricity. As the U.S. scales up its renewable energy infrastructure, the need for high-performance thermal fluids that can withstand extreme temperatures without degradation is on the rise.

Energy Efficiency and Sustainability Trends

In the context of increasing energy costs and environmental regulations, industries are seeking sustainable alternatives to conventional heating and cooling systems. Heat transfer fluids that are biodegradable, thermally stable, and have a long operational life are gaining popularity. The push for greener, low-toxicity, and recyclable HTFs is being fueled by environmental concerns and government incentives aimed at promoting sustainable industrial practices.

Technological Advancements in Fluid Chemistry

Ongoing RD in HTF formulation is leading to the introduction of fluids that can handle higher temperature ranges, reduce oxidation, and extend replacement cycles. Innovations in synthetic aromatic fluids, glycol-based fluids, and nanofluids are making thermal management more efficient, precise, and cost-effective. These advancements are especially important in high-stakes applications such as nuclear reactors, data centers, and aerospace components.

Demand from HVAC and Urban Infrastructure

The HVAC sector is another key growth area. Commercial buildings, hospitals, data centers, and smart homes are increasingly deploying thermal fluids in heating and cooling systems. Urbanization, coupled with stringent energy efficiency standards like LEED certifications, is creating a strong pull for next-generation HTFs.

Competitive Landscape

Key Market Players and Strategies

The US heat transfer fluid market is moderately consolidated, with several global and regional players competing through innovation, partnerships, and service excellence.

- Dow Inc. is a dominant force in the market with its flagship DOWTHERM and SYLTHERM product lines. The company invests heavily in RD and sustainability, offering fluids designed for extreme conditions with low environmental impact.

- Eastman Chemical Company offers a broad portfolio of high-performance HTFs for diverse industrial applications. Their focus on performance durability and eco-friendly formulations gives them a competitive edge.

- Paratherm (a Division of The Lubrizol Corporation) specializes in engineered thermal fluids tailored to specific industries such as food processing, plastics, and biodiesel. Their value proposition includes technical support, custom solutions, and reliability.

- Huntsman Corporation and BASF SE are also active players, offering customized solutions to niche markets like automotive and aerospace manufacturing.

Focus on Product Development and Customization

Companies are tailoring heat transfer fluid formulations to meet industry-specific needs such as low-temperature performance in the food industry, oxidation resistance in chemical plants, or high thermal stability for CSP installations. This customer-centric approach is fostering deeper market penetration and client loyalty.

Sustainability and Lifecycle Management

To meet environmental regulations and customer expectations, leading players are adopting circular economy principles—offering recyclable fluids, lifecycle tracking, and recovery services. Lifecycle management programs are emerging as a differentiator, ensuring safe handling, disposal, and replacement of fluids while minimizing waste and operational risk.

Distribution Channels and Technical Support

Efficient distribution and post-sale technical support are becoming vital in this market. Manufacturers that provide not only high-quality HTFs but also training, monitoring, and diagnostics support are winning in terms of both market share and brand reputation.

Challenges and Opportunities

Price Volatility of Raw Materials

The cost of key raw materials like base oils and additives can fluctuate significantly due to geopolitical tensions, supply chain disruptions, and refinery dynamics. This affects the pricing structure of HTFs, particularly synthetic and specialty fluids. Manufacturers are exploring alternative feedstocks and stabilizing supply chains through localized production.

Strict Regulatory Compliance

Compliance with chemical safety regulations, including REACH, TSCA, and OSHA, is a critical consideration. Manufacturers are being held to high standards regarding fluid composition, labeling, and hazard communication, which can add to production complexity but also encourages safer and greener innovation.

Opportunity in Data Centers and Electric Mobility

Emerging sectors such as data centers, EV battery thermal management, and electronics cooling present lucrative opportunities. These applications require non-conductive, high-performance HTFs with superior heat dissipation and chemical stability. As these sectors expand, so will demand for tailored heat transfer fluid solutions.

Growing Emphasis on Domestic Manufacturing

With rising supply chain concerns, there is an increasing focus on domestic HTF production in the U.S. Local sourcing ensures quality control, faster lead times, and compliance with national safety standards—providing a boost to regional manufacturers.

Outlook

Driven by industrial innovation, clean energy mandates, and demand for efficient thermal solutions, the US heat transfer fluid market is on a promising trajectory. From renewable energy to manufacturing and HVAC, HTFs are becoming indispensable to safe, sustainable, and high-performance operations. Companies that align their product offerings with industry-specific needs, environmental compliance, and technological advancement are well-positioned to lead this evolving market landscape.

More Trending Reports: