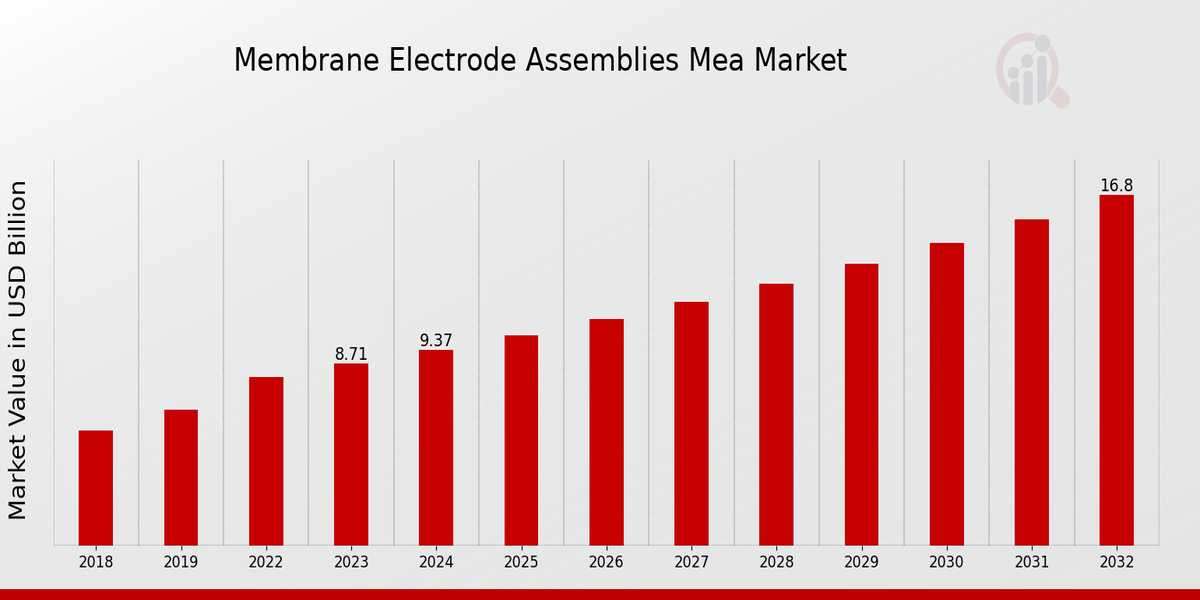

The global membrane electrode assemblies (MEA) market is experiencing strong growth, fueled by the rapid expansion of hydrogen energy systems and rising demand for clean, efficient power solutions. As the heart of proton exchange membrane (PEM) fuel cells, MEAs play a pivotal role in powering electric vehicles, stationary energy systems, and portable power devices—key components in the global shift toward zero-emission technologies.

Market Dynamics

The membrane electrode assemblies market is being shaped by a global energy transformation focused on decarbonization, electrification, and sustainability. As industries and governments push to reduce greenhouse gas emissions and adopt cleaner technologies, fuel cells have emerged as a critical energy solution, especially in mobility and industrial applications.

One of the strongest drivers of MEA market growth is the increasing adoption of hydrogen fuel cell vehicles (FCVs). Automakers around the world, including major OEMs in Japan, South Korea, Europe, and the U.S., are investing in hydrogen-powered passenger cars, buses, and commercial vehicles. MEAs are central to these systems, facilitating the electrochemical reaction between hydrogen and oxygen that generates electricity without combustion.

Beyond transportation, MEAs are increasingly deployed in stationary power applications. Fuel cells provide reliable backup power for data centers, telecom towers, hospitals, and off-grid facilities. Their scalability, efficiency, and ability to function in remote environments make them attractive for decentralized energy systems—particularly as global energy demand increases.

The integration of renewable energy sources such as solar and wind is also bolstering MEA demand. Hydrogen generated via electrolysis using renewable electricity can be stored and later converted to power through fuel cells. MEAs make this cycle possible, offering a clean energy storage and dispatch solution critical to grid stability.

Another driving force is supportive government policies and incentives for hydrogen energy infrastructure. Countries like Germany, Japan, South Korea, and the United States are investing billions in hydrogen roadmaps and national fuel cell programs. These initiatives are creating favorable environments for MEA development, manufacturing, and deployment.

Technological advancements are also contributing to market momentum. New MEA designs with improved durability, power density, and lower platinum content are addressing performance and cost challenges. RD efforts are focused on developing next-generation ionomer membranes, high-performance catalysts, and advanced electrode architectures.

Regionally, Asia-Pacific dominates the MEA market, led by strong government support, extensive hydrogen investment, and a growing fleet of fuel cell vehicles in Japan, China, and South Korea. North America and Europe follow closely, driven by clean transportation goals, renewable integration, and fuel cell investments by utilities and industrial players.

Competitive Landscape

The membrane electrode assemblies market is highly dynamic, with innovation and strategic collaborations at its core. Key players are leveraging RD capabilities, expanding production capacity, and forming partnerships to meet surging global demand and stay competitive.

3M is a leading MEA manufacturer, known for its advanced fluoropolymer-based membranes and high-performance catalyst coatings. The company is focused on improving power output and cost-efficiency for PEM fuel cells in automotive and industrial applications.

- L. Gore Associates is another major player, offering durable and high-efficiency MEA products under its GORE® Membrane brand. Its solutions are widely used in commercial fuel cell stacks and recognized for long operational lifespans.

Ballard Power Systems, a pioneer in hydrogen fuel cell technologies, manufactures its own MEAs tailored for heavy-duty mobility, including trucks, buses, trains, and marine vessels. Ballard is actively expanding through joint ventures and strategic alliances.

Johnson Matthey is a key supplier of MEAs and fuel cell components, with a strong emphasis on catalyst innovation. Its efforts to reduce platinum usage without compromising performance have strengthened its market positioning.

Cummins Inc. and Plug Power are aggressively investing in MEA and fuel cell stack development through vertical integration strategies and partnerships. Their focus is on powering commercial mobility, logistics hubs, and green hydrogen applications.

Other emerging companies and research institutions are working on next-generation MEA technologies, including non-PGM (platinum group metal) catalysts, hybrid membrane materials, and high-temperature PEM systems.

The competitive landscape is also shaped by collaborations between automakers, energy firms, and public agencies. Joint ventures, pilot projects, and shared RD initiatives are accelerating commercialization while reducing cost barriers.

Future Outlook

The future of the membrane electrode assemblies market is highly promising as the hydrogen economy continues to gain global traction. MEAs will remain a central technology in the expansion of fuel cells across transportation, power generation, and industrial use cases.

As innovation reduces cost and improves performance, MEAs will become more accessible for mass-market applications. Scalable manufacturing, supply chain resilience, and recycling of critical materials such as platinum will be critical areas of development.

In the years ahead, MEAs are expected to evolve with multifunctional architectures that support higher power densities, longer lifespans, and enhanced system integration. Their role in green hydrogen infrastructure, hydrogen refueling stations, and microgrids will further solidify their importance in a low-carbon future.

Ultimately, the membrane electrode assemblies market is poised to be a key enabler of clean energy transition—bridging the gap between sustainable fuel production and efficient power conversion across industries.

More Trending Reports:

global process and pipeline services