Future of Executive Summary GCC P2P Payment Market: Key Dynamics, Size Share Analysis

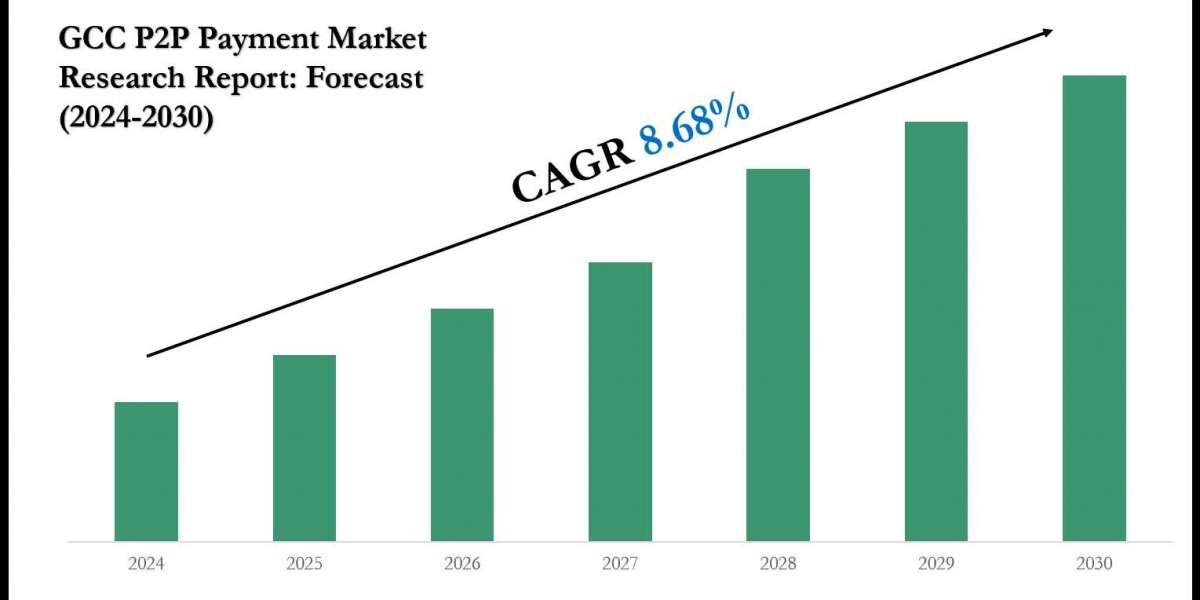

The GCC P2P Payment Market is estimated to grow at a CAGR of around 8.68% during the forecast period, i.e., 2024-30.

Top GCC P2P Payment Challenge Impacting the GCC P2P Payment Market Growth

Rising Cyber Security Breaches Lowering the Adoption of Digital Payment Solutions – The GCC countries have seen a rise in money laundering cybercrime activities, posing significant threats to their financial systems, national security, and economies. The growth of technology and social media has led to an increase in cybercrimes like blackmail, embezzlement, and hacking of bank accounts. Many cyberattacks target digital payment methods, which hinders their adoption, thus limiting the growth of the GCC P2P Payments Market.

Moreover, organizations in Saudi Arabia and the UAE were the main targets for cyber-attacks in the Gulf Corporation Council Countries between mid-2021 and mid-2022, according to Cybersecurity Firm Group-IB. Thus, the evolving nature of cybercrime and the sophistication of money laundering techniques are presenting challenges for market expansion.

In case you missed it, we are currently revising our reports. Click on the below to get the latest research data with forecast for years 2025 to 2030, including market size, industry trends, and competitive analysis. It wouldn’t take long for the team to deliver the most recent version of the report.

Unlock exclusive insights into the GCC P2P Payment Market – request your free sample PDF now and explore key trends, growth drivers, and competitive strategies shaping the industry- https://www.marknteladvisors.com/query/request-sample/gcc-p2p-payment-market.html

Understanding the Core Segments in the GCC P2P Payment Market

GCC P2P Payment Size, Share Industry Trends Analysis - By Transaction Mode (Short Message Service (SMS), Mobile Apps, Smartcard/NFC (Near field communication), Others (Bank Transfers, Digital Wallets, etc.)), By Location (Remote Payment, Proximity Payment), By End User (Retail E-Commerce, Travel Hospitality, Transportation Logistics, BFSI, Healthcare, Others (IT Telecom, Media Entertainment, etc.)), and Others

Geographical Analysis of the GCC P2P Payment Market

-By Region

- Saudi Arabia

- The UAE

- Qatar

- Kuwait

- Oman

- Bahrain

Who Dominates the GCC P2P Payment Market Insights on Key Industry Players?

Companies are strengthening their presence in the GCC P2P Payment Market by adopting strategies such as forming strategic alliances, leveraging AI, entering partnerships, pursuing mergers and acquisitions, expanding into new regions, and introducing innovative products and services.

- Paypal

- Apple Pay

- Venmo

- Cash App

- Google Pay

- Square Cash

- Zelle

- Noon Pay

- Mamo Pay

- Ziina Pay

- MoneyGram International, Inc.

- Beyon Money

- Others

Tap into future trends and opportunities shaping the GCC P2P Payment Market Download the complete report: https://www.marknteladvisors.com/research-library/gcc-p2p-payment-market.html

Why Choose This MarkNtel Advisors Research Report

- Comprehensive Insights – Offers a 360° view of the GCC P2P Payment, combining qualitative and quantitative analysis for a deep understanding of trends, drivers, challenges, and opportunities.

- Reliable Data Sources – Data is gathered through verified primary and secondary sources, ensuring accuracy and credibility.

- Actionable Forecasts – Advanced predictive modeling and time-series analysis provide practical insights to guide strategic decisions and business planning.

- Expert Analysis – Insights from industry experts help interpret complex GCC P2P Payment dynamics, delivering clarity beyond the numbers.

- Customized Strategic Reporting – The report includes detailed charts, graphs, and strategic recommendations tailored to support business growth and investment decisions.

- Trusted Methodology – Built on rigorous research principles, including precise sampling, data validation, and forecasting techniques, reflecting the trust businesses place in MarkNtel Advisors.

"This report equips decision-makers with actionable intelligence, enabling them to navigate GCC P2P Payment complexities with confidence and foresight."

Gain exclusive access to our comprehensive insights on the Future of GCC P2P Payment Market. With tailored licensing options, including Mini Report Pack, Excel Data Pack, Single User, Multiuser, and Enterprise Packs, our research empowers organizations to navigate dynamic GCC P2P Payment trends effectively.

Select a License That Matches Your Business Requirements with Instant Offer - https://www.marknteladvisors.com/pricing/gcc-p2p-payment-market.html

About us:

We are top leading GCC P2P Payment research company in Noida, India and have our existence across the GCC P2P Payment for many years and have conducted multi-industry research across 80+ countries, spreading our reach across numerous regions like America, Asia-Pacific, Europe, the Middle East Africa, etc., and many countries across the regional scale, namely, the US, India, the Netherlands, Saudi Arabia, the UAE, Brazil, and several others.

Being one of the most efficient GCC P2P Payment research companies in India, our specialized team of experienced efficient GCC P2P Payment research professionals is capable of grasping every minute and valuable information data of the GCC P2P Payment to offer our clients with satisfactory details. Our company has served the biggest GCC P2P Payment research firms in India at leading positions and is proficient in managing all types of GCC P2P Payment research projects.

Trending blog:

- https://www.marknteladvisors.com/blogs/top-e-scooter-companies-in-thailand.html

- https://futureGCC P2P Paymentresearchh.blogspot.com/2025/09/future-of-home-office-furniture-GCC P2P Payment.html

- https://futurereadyresearch.blogspot.com/2025/08/future-of-yoghurt-market-uae.html

- https://futurereadyresearch.blogspot.com/2025/08/future-of-preventive-cardiology-market.html

- https://futurereadyresearch.blogspot.com/2025/08/future-ifm-market-uae.html

- https://futurereadyresearch.blogspot.com/2025/08/future-of-the-saudi-arabia-cyber-security-market.html

- https://medium.com/@bhattsonu065/ai-agent-2025-market-size-future-trends-and-industry-impact-1c2696

- https://www.openpr.com/news/4166508/saudi-arabia-dates-market-value-to-reach-286-29-million-by-2030

- https://www.prnewswire.com/news-releases/ai-agent-market-forecast-to-reach-42-7-billion-by-2030-nor

Reach Us:

MarkNtel Advisors

Office No.109, H-159, Sector 63, Noida, Uttar Pradesh-201301, India

Contact No: +91 8719999009

Email: sales@marknteladvisors.com

Visit our Website: https://www.marknteladvisors.com