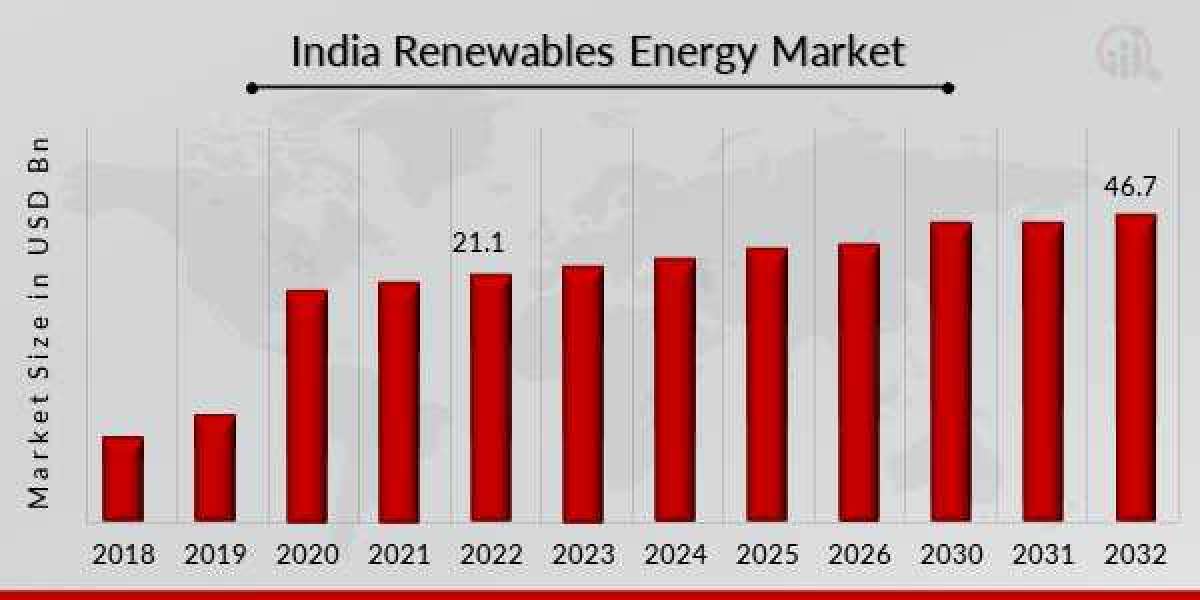

The India renewable energy market is gaining significant momentum as the country aggressively shifts towards sustainable energy solutions to meet its ambitious net-zero targets. Backed by strong policy initiatives, technological innovation, and growing investor confidence, India is emerging as a global leader in renewable energy deployment. With a clear focus on solar, wind, hydro, and bioenergy, the market is undergoing a transformation driven by climate commitments, economic development, and energy security goals.

India's renewable energy capacity crossed 125 GW in 2023, making it the fourth-largest renewable energy producer globally. As per national targets, the country aims to reach 500 GW of non-fossil fuel capacity by 2030, opening expansive opportunities across equipment manufacturing, grid infrastructure, and project development.

Market Dynamics

One of the key drivers of the India renewable energy market is the growing electricity demand from urbanization, industrialization, and rural electrification . As one of the fastest-growing economies, India's energy appetite is rising, and renewables offer a cleaner, scalable, and cost-effective solution to meet this demand while minimizing environmental impact.

Government initiatives and policy support continue to play a pivotal role. The Production Linked Incentive (PLI) scheme for solar PV manufacturing, viability gap funding for offshore wind projects, and green hydrogen missions are examples of comprehensive policy actions designed to boost domestic capability and global competitiveness in renewables.

Falling costs of renewable technologies have significantly enhanced their commercial viability. The cost of solar PV modules and wind turbines has declined steadily, making renewables cost-competitive with conventional energy sources. This trend has triggered increased participation from private players, developers, and foreign investors.

Grid integration and storage challenges, once seen as roadblocks, are being addressed through strategic investments in transmission upgrades, hybrid renewable projects, and energy storage systems. The Green Energy Corridor project and large-scale battery storage tenders demonstrate the country’s proactive approach in managing grid variability and ensuring round-the-clock power.

Decentralized renewable energy (DRE) applications are gaining ground, especially in rural and semi-urban regions. Rooftop solar, mini-grids, and solar-powered irrigation systems are enabling energy access and economic empowerment at the grassroots level, aligning with India’s inclusive development goals.

Another growing area of opportunity is corporate renewable energy procurement. Large businesses and tech companies in India are increasingly signing power purchase agreements (PPAs) to meet their sustainability targets, driving demand for utility-scale and open-access projects.

Competitive Landscape

The India renewables energy market features a dynamic mix of public sector undertakings (PSUs), global energy firms, domestic developers, and technology providers. Key players include Adani Green Energy, Tata Power Renewable Energy, ReNew Power, NTPC Renewable Energy, Azure Power, and international firms like Siemens Gamesa, Vestas, and Enel Green Power.

Adani Green Energy, one of India’s largest renewable energy developers, has been expanding its solar and wind portfolio aggressively with a goal to become the world's largest renewable energy company by 2030. Their projects are spread across states and often integrated with digital asset management platforms.

ReNew Power, a leading independent power producer, continues to scale up its wind-solar hybrid projects and green hydrogen ventures. With a strong focus on innovation and ESG compliance, it attracts substantial global funding.

Tata Power Renewable Energy leverages its legacy and engineering expertise to implement rooftop solar, floating solar, and large utility-scale projects. The company is also expanding into solar microgrids for rural electrification.

NTPC Renewable Energy, a government-owned entity, is spearheading large-scale solar parks, green hydrogen hubs, and offshore wind projects under the national renewable expansion strategy. Its public-sector backing offers financial stability and project execution strength.

Azure Power specializes in utility-scale solar projects with a presence across multiple Indian states. Its emphasis on long-term PPAs and efficient project execution makes it a reliable partner in the clean energy space.

Global OEMs like Siemens Gamesa and Vestas provide advanced wind turbine technology and services tailored for Indian conditions. These firms are involved in wind park development and lifecycle support, ensuring consistent performance across the value chain.

Startups and emerging tech firms are also contributing through innovations in energy storage, predictive analytics, and solar equipment manufacturing. This competitive intensity fosters continuous improvement, pricing efficiency, and diversification of offerings.

Future Outlook and Strategic Opportunities

The India renewable energy market is on an upward trajectory with long-term fundamentals firmly in place. As the world's third-largest emitter, India's clean energy transition holds global significance. With climate finance, technology transfer, and international collaboration strengthening, the sector is poised for a decade of unprecedented growth.

Green hydrogen production is emerging as the next frontier, with India aiming to become a global hub for low-cost, renewable hydrogen. This development will complement the renewable energy sector and open new avenues for investment, exports, and job creation.

Offshore wind and floating solar projects, still in nascent stages, are expected to accelerate in the coming years as policies and pilot projects take shape. These segments will help unlock new capacities in coastal and water-rich regions.

Energy storage and hybrid systems will be crucial for grid flexibility and renewable firming. Battery manufacturing, pumped hydro, and smart inverter systems will become high-priority investment areas.

Challenges such as land acquisition delays, regulatory uncertainty, and grid congestion persist. However, ongoing policy reforms, digitalization, and industry collaboration are gradually addressing these hurdles.

In conclusion, India's renewable energy market represents one of the world's most promising clean energy frontiers. With the right mix of policy support, investment, and innovation, India is set to lead the global shift to sustainable, affordable, and inclusive energy.

More Trending Reports: